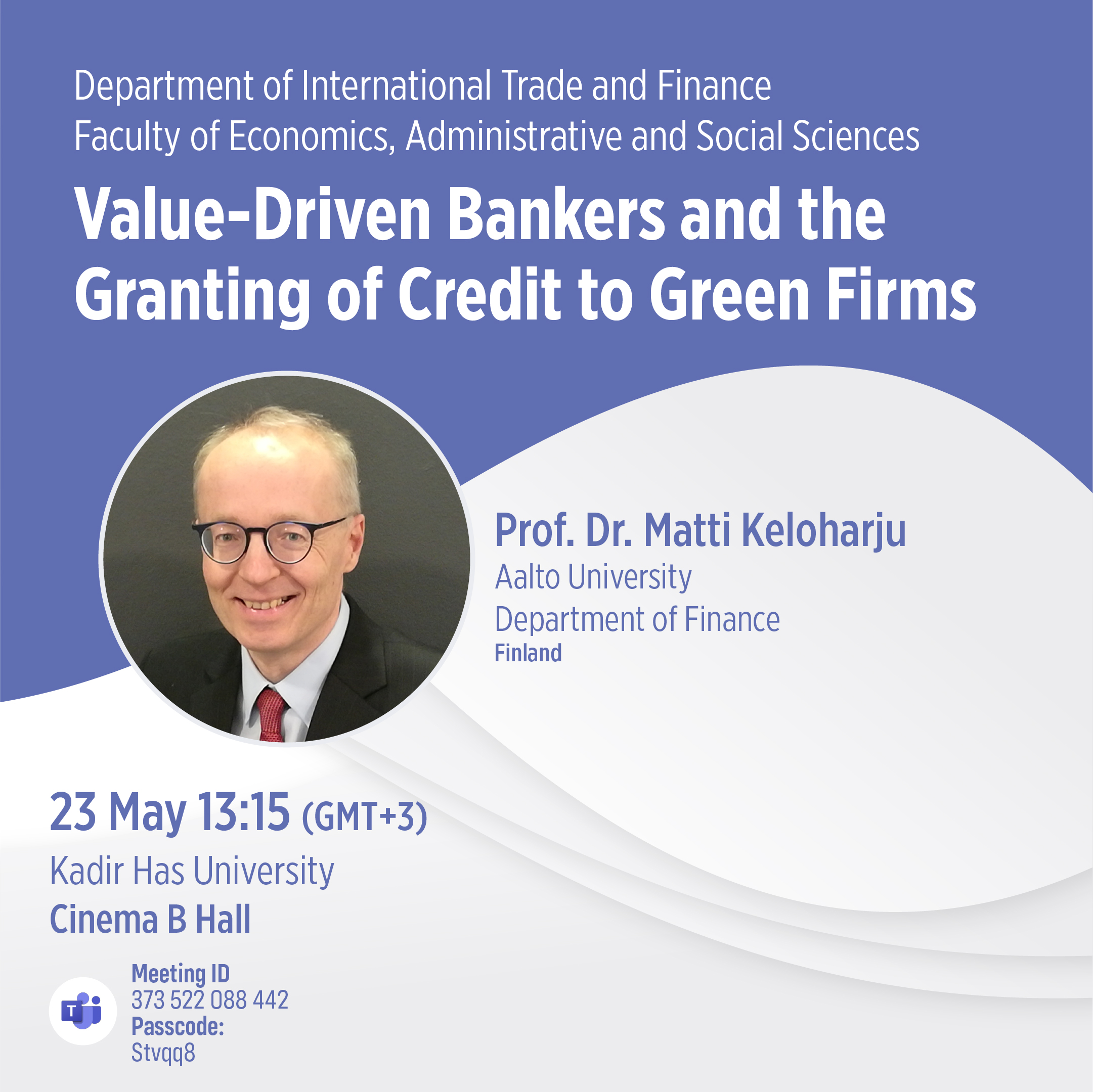

Value-Driven Bankers and the Granting of Credit to Green Firms

Speaker: Professor Matti Keloharju

Institution: Aalto University, Finland

Day and Time: May 23rd, 2024 (Thursday), 13:15 (GMT+3)

Title: “Value-Driven Bankers and the Granting of Credit to Green Firms.”

Location: KHAS Cinema B and KHAS Youtube channel

Meeting ID: 373 522 088 442

Passcode: Stvqq8

About the speaker:

Matti KELOHARJU is Aalto Distinguished Professor and Eero Kasanen Professor of Finance at the Aalto University School of Business. He is also Research Fellow of the CEPR, Founding Member of the European Household Finance Network, and Research Associate of the IFN, and has in the past held visiting positions at Harvard Business School, New York University, and UCLA. He has specialized in applying unique data sets to analyze the behavior of various economic agents, such as individual and institutional investors, corporate executives, bankers, and consumers, and the consequences of their behavior. Professor Keloharju’s work has been published in top journals such as the Journal of Finance, Journal of Financial Economics, Review of Financial Studies, Review of Economics and Statistics, and Management Science, and his research has been widely cited in the international news media, including the New York Times, Bloomberg News Service, Financial Times, and Wall Street Journal. He has received numerous research awards, such as the Smith Breeden Distinguished Paper Prize and the Best Conference Paper Runner-Up Award at the European Finance Association (EFA) Conference. In the 2016-20 period, he was the recipient of the prestigious Academy Professorship Grant from the Academy of Finland. He remains an active member of the academic community serving in the program committees of many of the main finance conferences. He was the President of EFA in year 2021 and member of its Executive Committee between 2017 and 2023.

Abstract: How do bankers treat green firms? Utilizing unique loan application and banker preference data from a mid-sized bank, we find that customer managers, serving as front-line bankers, provide more favorable recommendations for green firms, particularly when they hold green values. However, a minority of environmentally skeptical managers counteract this trend. They fake green interests when their recommendations bear no weight, and conversely, diminish their endorsements to green firms when they do hold significance. Additionally, brown loan officers, acting as superiors to the managers, strive to offset positive green firm evaluations by downgrading them.