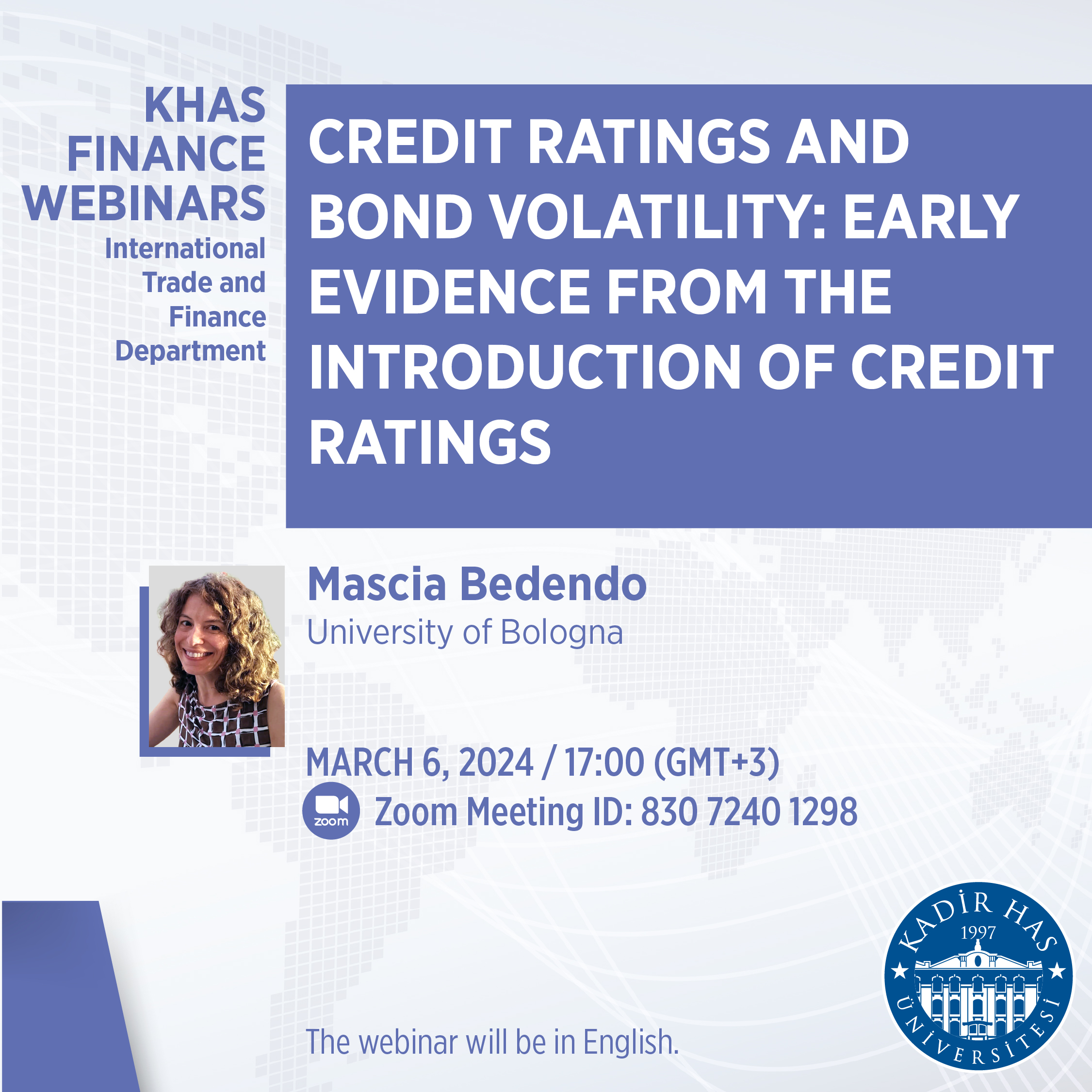

Credit Ratings and Bond Volatility: Early Evidence from the Introduction of Credit Ratings

Speaker: Mascia Bedendo

Institution: University of Bologna

Day and Time: 06 March 2024 (Wednesday), 17.00 (GMT+3)

Title: Credit Ratings and Bond Volatility: Early Evidence from the Introduction of Credit Ratings

Zoom Link: https://us02web.zoom.us/j/83072401298

Abstract: We exploit the unique setting provided by the introduction of credit ratings in the early 20th century to explore their value to bond investors. Specifically, we investigate whether the adoption of ratings reduced the uncertainty surrounding the assessment of bond values by testing the impact of ratings on bond volatility in a sample of bonds traded on the New York Stock Exchange. By using both difference-in-differences and matching techniques, we find that the introduction of bond ratings resulted in a decrease in the volatility of rated bonds, particularly for those bonds that were more volatile prior to their rating assignment. Our findings support an increase in agreement amongst investors about the credit quality and the value of rated bonds. Additionally, they are consistent with an increase in investors’ attention, which helped facilitate the incorporation of information in bond prices.

Available at SSRN: https://ssrn.com/abstract=4547988

About the speaker: Mascia Bedendo is a full Professor of Finance in the Department of Management at the University of Bologna. Before joining the University of Bologna, she was Professor of Finance at Audencia Business School, Assistant Professor at Bocconi University and Postdoctoral fellow at Imperial College London. She held visiting positions at Collegio Carlo Alberto, Imperial College London and Cass Business School. She holds a Ph.D. in Finance from the University of Warwick. Her research has been published in high-impact journals such as Journal of Financial and Quantitative Analysis, Journal of Money, Credit and Banking, Journal of Corporate Finance, and it is mostly focused on firm financing and credit risk. Mascia has gained international teaching experience at all levels (undergraduate, graduate, Ph.D., executive). She acts as independent director of Banca Sella since April 2020.